Non classé

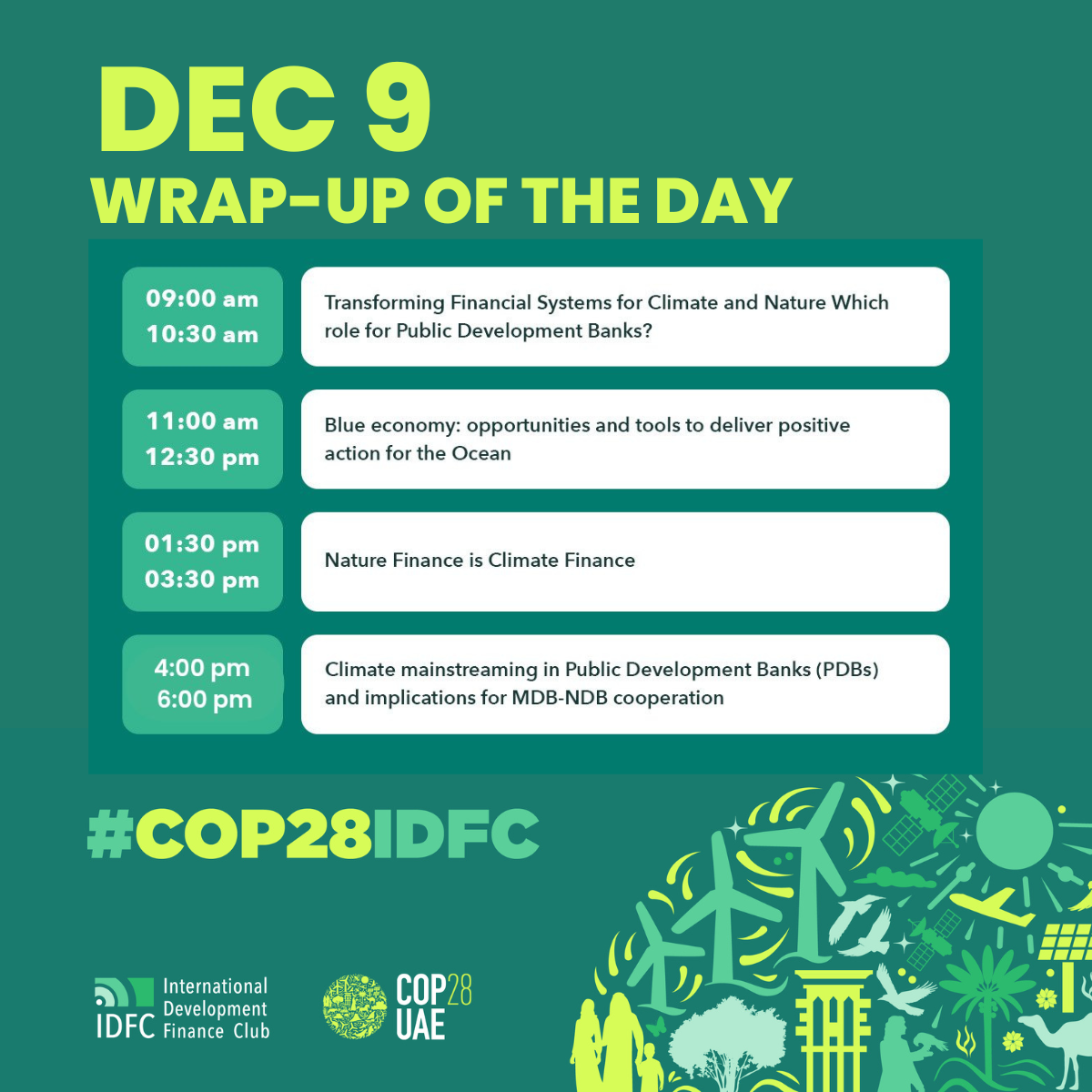

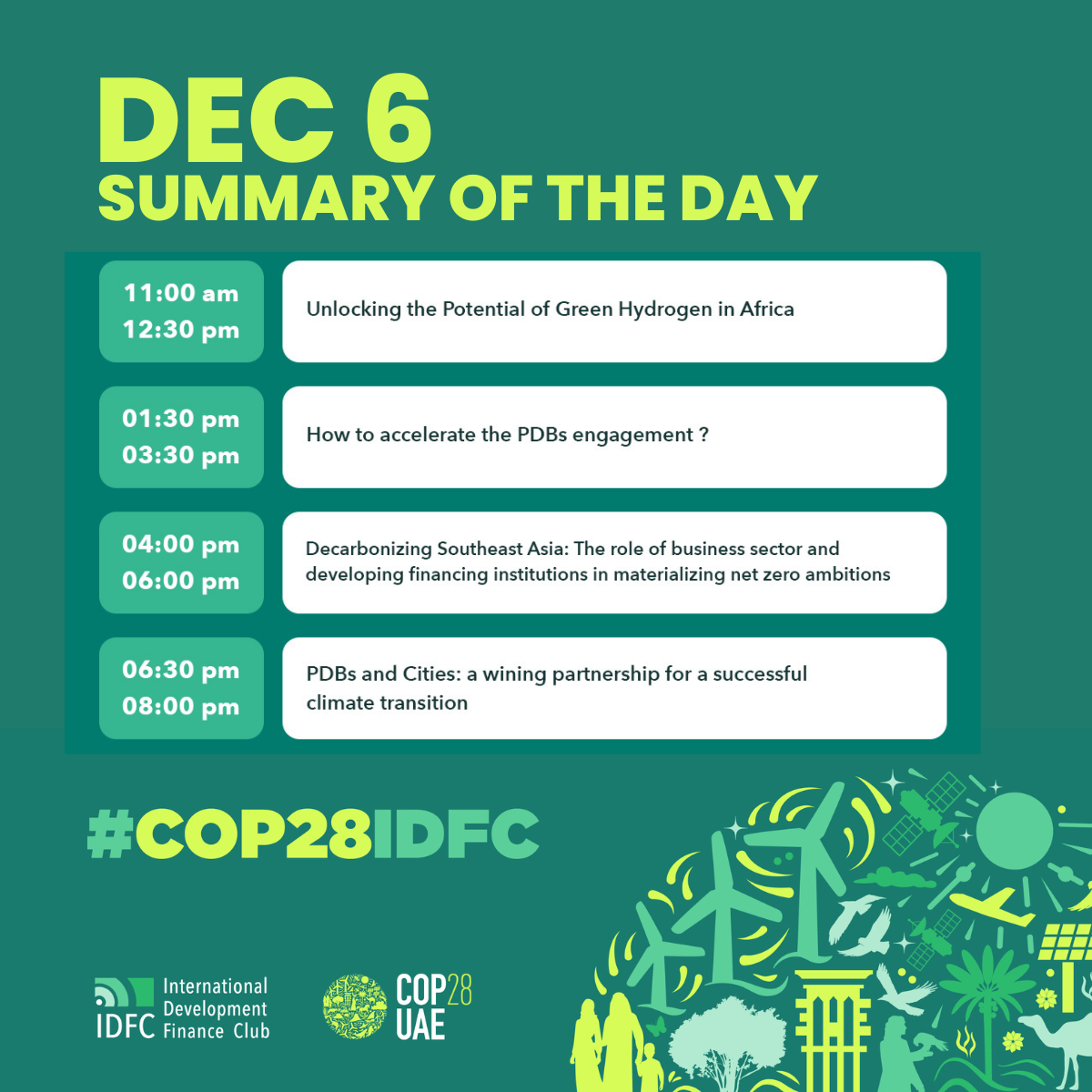

COP28IDFC DEC6 – Wrap up

19 January 2024New day, new agenda on #COP28IDFC Pavilion.

Find below the topics tackled today and a summary for each, 4 events on #PDBs, #SouthAsia, #energytransition, #sustainability, #climatefinance

Watch the replay here:

11AM Unlocking the Potential of Green Hydrogen in Africa

The discussions aimed to:

- To provide context on green hydrogen as a key enabler for developing countries and transition economies such as South Africa and Namibia to achieve industry decarbonization and development.

- Explore current policy, regulatory, climate impact and industrial development aspects of green hydrogen being undertaken in developing countries including the Southern

Moderator:

- Catherine Koffman – Group Executive : Project Preparation, DBSA

Panelists:

- Andrew Johnstone – CEO, Climate Fund Managers

- Benedict Libanda – CEO, Environment Impact fund of Namibia

- Eluma Obibuaku – Senior Vice President, Power , Africa Finance Corporation (AFC)

- Joanne Bate – Chief Operations Officer, Industrial Development Corporation (IDC)

- Jonas Moberg – CEO, Green Hydrogen Organization

- Jabri Ibrahim – Africa Special Programmes Lead for the High-Level Champions

Key takeaways:

- The race to end the climate crisis is more urgent with every passing day. Transitioning off fossil fuels and onto green hydrogen as an energy source has a huge role to play in reversing global warming, and Africa, with its abundant natural resources and low production costs, is well placed to lead this chapter in saving the planet and its inhabitants from a very uncertain future.

- Unlocking its potential will require an estimated USD900 billion in investment by 2050. This is far beyond the capacity of public financing alone and blended finance offers a solution to mobilising capital at scale by utilizing public capital to de-risk projects and enable private capital to participate alongside. With a blended approach, the public and private sectors can work in partnership to create green hydrogen solutions at pace, and scale, accelerating the transition to a new sustainable global energy landscape

- South Africa has a once in a generation opportunity to develop the green hydrogen value chain which presents a transformative opportunity for society, the economy and the environment. By harnessing the power of green hydrogen we have the chance to revolutionise energy, reduce carbon emissions and create sustainable industrial value chains and job opportunities for future generations

4PM Decarbonizing Southeast Asia: The role of business sector and developing financing institutions in materializing net zero ambition

This session touched on the dynamic and rapidly growing Southeast Asia. It invited key speakers from development financing institutions, the private sector, banking institutions, and government officials from the region to deep-dive into on-the-ground efforts already underway. They collectively discussed and charted a path toward achieving net-zero ambitions.

Panelists:

- Megumi MUTO (keynotes and panelist), Vice President and Chief Sustainability Officer, JICA

- Edwin Syahruzad (keynotes), President Director, PT Sarana Multi Infrastruktur (PT SMI)

- M Koji Fukuda (moderator), Chief Advisor, JICA Project for Support for planning and implementation of the Nationally Determined Contributions in Vietnam(SPI-NDC)

- Nguyen Nhat Ha Chi, ESG Manager, Dragon Capital

- Miki Yamanaka, Senior Manager, CSR and Global Environment Center, Daikin Co., Ltd.

- Lung Quang Huy, Head of Mitigation Division, Dept of Climate Change, Ministry of Natural Resources and Environment (MONRE)

- Masamichi Kono (moderator), Senior Advisor, MUFG

- Pradana Murti, Director of Risk Management, PT SMI

- Hiroshi Ota, Fellow, Sustainability Office, Dai-ichi Life Holdings, Inc

- Chikako Matsumoto, Executive Officer, Sumitomo Mitsui Trust Holdings Inc.

Key takeaways:

- This session touched on the dynamic and rapidly growing Southeast Asia, and invited key speakers from development financing institutions, private sector, banking institution, and government officials from the region to deep dive into in-country efforts.

- In-country experiences and situations of private sector engagement and investment for net zero are diverse.

- While role of banking sector, development financing institutions, and governments are also diverse, cooperations in the field of capacity building, policy formulation and risk sharing can be important.

Specific interventions:

- A panelist pointed out challenges are to develop a framework including human resources and the government of each country to formulate policies for transition.

- Another panelist pointed on the importance of risk sharing through insurance and securitization schemes.

- At the same time, another panelist shared their current effort for the establishment of a blended finance platform

Next steps and call to action:

- Dr. Muto, CSO of JICA, announced JICA’s official participation in the Asian Transition Finance Study Group (ATF SG) and IDFC may foster discussion on energy transition of Southeast Asia.