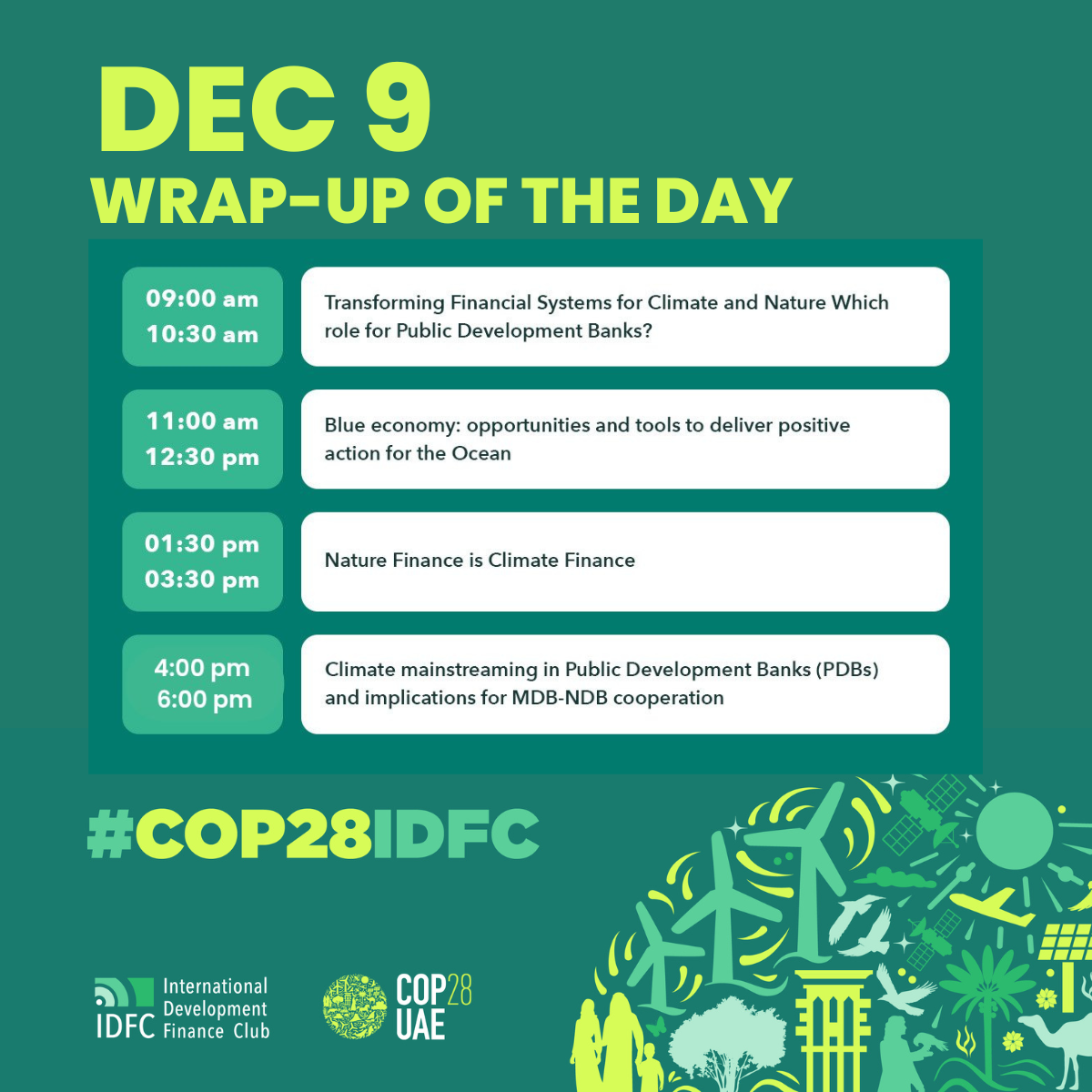

COP28IDFC DEC9 – Wrap up

10 December 2023Find below the topics tackled on the 9 of December.

We holded 2 events on DFIs and #greenhydrogen.

Watch the replay here:

9AM – Transforming Financial Systems for Climate & Nature Which role for Public Development Banks?

Pressure is mounting for the transformation of the financial system to fully align with climate, nature and the SDGs. Based on an ongoing collaborative enquiry led by WRI in the Amazon region, the event will discuss how to achieve this concretely, at the local level, as well as the possible role of Public Development Banks.

Panelists:

- Shuang Liu, Acting Global Director, Finance Center, World Resources Institute

- Anderson Caputo Silva, Division Chief, Connectivity & Capital Markets, IADB

- Alejandra Lopez, Head of Climate Diplomacy, Transforma

- Olympus Manthata, Head, Climate and Environment Finance, DBSA

- Edgardo Alvarez, Secretary General, ALIDE

- Mustapha Kleiche, Head, IDFC Climate and Nature Facility

Moderator: Alexis Bonnel, Strategy & Foresight, AFD

Key takeaways:

- Public Development Banks can play a critical role (PDBs) to contribute to the greening of the financial systems within which they operate, beyond the provision of direct climate investment finance. This potential, however, largely remains to be tapped.

- Enhanced collaboration between the different categories of PDBs (multilateral, international, domestic) is critical.

- There also is a need to reinforce the technical and financial capacities of National Development Banks.

- Working with and engaging the other stakeholders of the system, beyond the PDB community (policy makers, regulators, other private financial institutions, credit rating agencies, think tanks and CSOs) is equally essential.

The discussion started with a presentation of the ongoing collaborative enquiry by WRI in the Amazon Region. IADB presented the Green Coalition for the Amazon and its objectives. The work by WRI fully resonated with the Coalition’s work.

Transforma and DBSA highlighted several challenges on the difficult road to mobilize PDBs towards financial system transformations, including regarding capacities, policy and regulatory incentives, and financial instruments.

ALIDE and the IDFC Climate Facility presented the different initiatives they champion to help address such challenges, including regarding capacity building and knowledge and best practice dissemination.

1:30PM – Nature Finance is Climate Finance

The main objective of this event was to show that biodiversity and climate form a double crisis and that financing biodiversity can be a cost-effective way of financing mitigation activities.

Key Note Speech: Prof. Hans-Otto Poertner: Marine biologist and climate researcher.

Panelists:

- Stefan Wintels: CEO KfW

- Boitumelo Mosako CEO DBSA (Development Bank of Southern Africa)

- Alicia Montalvo: Climate Action and Positive Biodiversity Manager at CAF (Development Bank of Latin America and the Caribbean).

- Leslie Kapin, Director of Impact, Astanor Ventures.

- Andrew M. Deutz: Director of Global Policy, Institutions and Conservation Finance at TNC (The Nature Conservancy).

Moderator: Peter Hilliges, KfW

Key takeaways:

- Biodiversity has finally become a part of the sustainability debate

- Nature Finance has a double benefit.

- Development Banks have a major role to play here.

- But they all still lag behind on nature finance. They have to do more.

Quotes:

-Hans-Otto Pörtner: “Keeping nature intact is important but there is no way around emissions reductions.”

-Stefan Wintels: “It is urgent, urgent, urgent” to tackle this double crisis of biodiversity loss and climate change together.”

-Boitumelo Mosako: “We have acknowledged the meaning of biodiversity in our decision making processes.”

-Alicia Montalvo said: Biodiversity is not the little sister of climate change, it´s equally important.

-Leslie Kapin: “For the private sector to be taken aboard it needs clear KPIs.)

-Andrew Deutz: “Originally in climate nature was a victim. Not it´s part of the solution. That´s new.”

Outcome:

All participants agreed that more has to be done for nature finance. They all said they would work on it in their respective institutions and organization. KfW e.g. is working on a comprehensive biodiversity strategy for the whole Banking Group.

6:30PM – Climate Maintreaming in PDBs and implications for MDB NDB cooperation

Public Development Banks (PDBs) – including National Development Banks (NDBs) and Multilateral Development Banks (MDBs) – vary in their approaches to climate finance, and in their alignment with the Paris Agreement specifically. Differences in political economic contexts, institutional form and scale, as well as mandate, influence the paths to alignment (both optimal and actual) followed across the PDB ecosystem.

Simultaneously, discussions regarding reform of the International Financial Architecture (IFA) have put the spotlight on the importance of enhanced engagement between PDBs in emerging markets and developing economies (EMDEs) and the major MDBs. However, the current state of engagement between MDBs and PDBs in EMDEs, particularly regarding climate-related financial flows from developed to developing economies, is not well documented.

This event sought to discuss the findings of a paper between E3G and CPI about the current state of interactions among MDBs and PDBs to discuss opportunities with PDBs representatives about to increase the volume, effectiveness, and equity of global climate finance, as part of progress on wider IFA reform. This included the question of how the Paris alignment process and relationships between MDBs and NDBs can be optimized to increase the volume and effectiveness of such on-lending.

Moderator: Laura Sabogal, E3G (Senior Policy Advisor)

Keynote: Nicole Pinko, CPI (Manager)

Panelists:

- Cinzi Losenno, EIB (Senior Climate Change Specialist/Adaptation Lead)

- Isabelle Braly-Cartillier, IDB (Partnerships and Mobilisation Lead Specialist

- Komlanvi Moglo, BOAD (Expert in Renewable Energy/Climate Finance)

- Siloshini Naidoo, DBSA (ESG Head)

- Gan Gan Dirgantara, PT SMI (Head of Environmental, Social and Technical Evaluation Division)

Key takeaways:

- NDBs are key partners for MDBs in delivering on climate and development objectives. High transaction costs and sheer size of MDBs makes it harder for them to reach communities in the same way that NDBs can facilitate this.

- We need to think about all of the different actors in the system of development and climate finance, to ensure that actors are complementary and do not overlap, to make the maximum use of the resources that we have.

- The potential financing for climate is there, but the fundamentals needed for the catalytic, scalable, sustainable financing that the climate needs are still not yet there.

Remevant interventions from the speakers:

- Reflection of movement from only the more “traditional” MDB-NDB relationships of loans and TA, to more advanced relationships such as through using guarantees, sustainability-linked loans, and so forth.

- Political stability and security is a first order concern prior to talking about development project: contextual issues such as this can have a huge impact on portfolios and pipeline of PDBs operating in conflict/instability affected regions

- Recognition of mandate, client base, and capacity as highly relevant and variable across NDBs in terms of their ability to account for climate considerations. It is a very diverse ecosystem of institutions.

- It is important to consider the implications of climate mainstreaming requirements on private sector mobilization – how does the private sector respond to the additional costs/processes and how can these be optimized?

- TA engagement to accompany finance flows from MDBs with NDBs can effectively support development of internal capacities for ensuring climate is mainstreamed across operations. TA can still be incredibly valuable, for relatively low cost.

- Important going forward to consider challenges associated with the complexity of MDB-NDB financing at the transaction-level: this level of granularity would be useful to investigate further.

- Joint financing platforms are very useful in bringing together the different sources of finance and assistance which are needed (e.g. commercial banks, development banks, and TA providers).

Commitments:

- The session was not geared around extracting particular commitments or deliverables. Rather it was intended to start a conversation and raise awareness around improving climate mainstreaming and on-lending across MDBs and NDBs.

- E3G & CPI’s joint report on this (published in the week before the session) was presented during the session for this purpose.

Call for action:

- The report was recognized as having the implicit message that reporting is clearly an issue across Public Banks in general. Participants recognized that this needs to improve in order for these institutions to be able to tell their own stories. Improving reporting can have co-benefits across other internal processes such as governance.

- There was a call for increased flexibility by MDBs in their arrangements with NDBs, in order to reduce transaction costs. For example, through shared understandings and acceptance of common standards for E&S safeguards, in order to make it more straightforward for NDBs to receive finance from different institutions.

The session was based on a new report issued jointly by E3G and CPI on MDB-NDB on lending and climate mainstreaming, which can be found at either of the following pages: