COP28IDFC DEC1 – Wrap up

29 November 2023The first day of the #COP28IDFC pavilion is now closed, on this occasion the Club thanks all the panelists who contributed to the 2 first events.

Below you can find the key takeaways and replay:

The Opening event: IDFC contribution to Climate finance, a record high

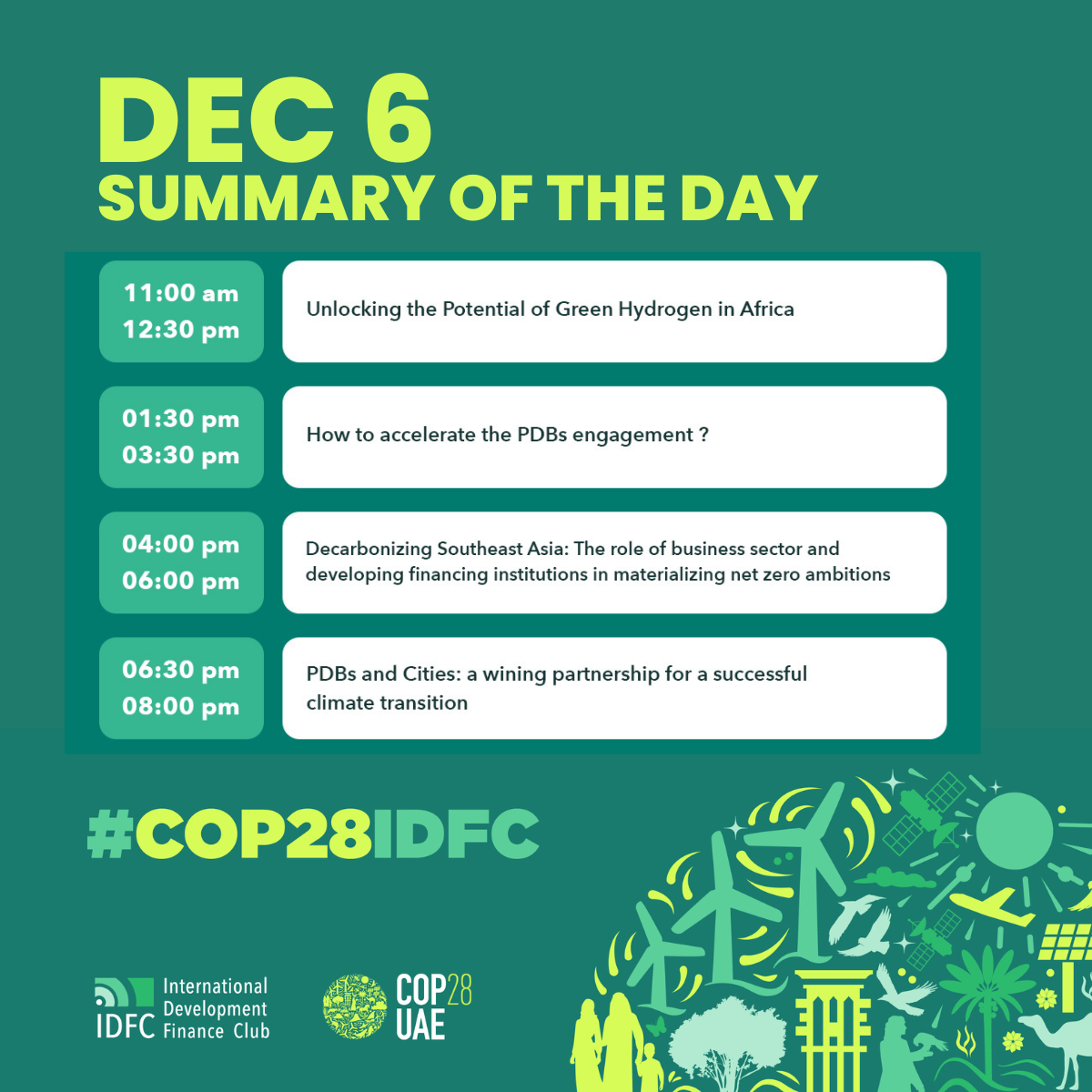

Today (1DEC) was the launched of our IDFC Pavilion #COP28IDFC with our opening side-event under the topic IDFC contribution to Climate finance: A record high.

This high-level side-event was the opportunity to present IDFC contribution to Climate finance, in particular the Green Finance Mapping 2023, and to illustrate the role of public development banks to achieve Paris Agreement alignment.

With 288Bn USD of green finance in 2022, a record high, IDFC is the first public provider of climate finance in the world. IDFC also aims to promote the role of public development banks and to contribute to the international agenda and debates on climate, for instance on the New Collective Quantitative Goal (NCQG) or on the different approaches for financial institutions to align on the Paris Agreement.

Based on an overview of IDFC main deliverables this year, this side-event explored ideas to go beyond in the coming years to meet Paris Agreement Goals.

We would like to thank our 6 panelists for their contribution:

- Rémy Rioux, CEO of AFD and Vice-Chair IDFC

- Barbara Büchner, Global Managing Director CPI

- Javier Diaz, CEO Bancoldex, Co-chairman IDFC

- Benoît Leguet, CEO the Institute for Climate Economics

- Serge Ekué,CEO BOAD, Co-chairman IDFC

- Nicolas Picchiottino, Secretary General of IDFC

During this side-events the panelists have presented different IDFC deliverables that you can find below:

Green Finance Mapping 2023

Key findings:

- $288 billion in green finance in 2022, a record high

- $1.5 trillion in total green finance since 2015

- $245 billion in mitigation finance in 2022

- Adaptation finance increased 52% to a record high of $31.6 billion

- $18 billion in biodiversity finance in 2022

· Green Finance Mapping 2023 (with the progress report on IDFC State of Ambition)

This annual report had been delivered for more than a decade in collaboration with the Climate Policy Initiaive.

Barbara Büchner, Global Managing Director, CPI, highlighted the key takeaways of 2022 outcomes from the IDFC members: “mitigation continues to receive the majority of climate finance in 2021/222 accounting for 91%” .

The 4 priorities identified:

- transforming the financial system both across public and private finance

- bridging climate and development needs: harness the benefits of synergies

- mobilizing domestic capital market: not only about tackling assistance, better reporting systems

- acting to improve data as “you cannot manage what you cannot measure” Barbara Büchner mentioned

The presentation of those results was the occasion to reclarify the IDFC strategy toward Climate Finance. Thus, Javier Diaz, CEO Bancoldex and Co-chairman of the IDFC, shared “my sense of the future is that we are worlking more together and deepening the collaboration to double or triple the 1.5 Trillion”.

Rémy Rioux, CEO of AFD and former Chairman of the IDFC valued “our strength is that we accumulated a knowledge about climate which is not commercial or private & we need to continue to work collectively on what it means to align on the project financing, we have to define and be consistent with the goals […] aligned with this collective effort, the IDFC and Finance in Common have been prefigurating a new global financial architecture and rethinking international cooperation”.

Common principles on mitigation and adaptation: adoption of a new methodology

IDFC announced the adoption of the revised version of the Common Principles on Mitigation and the updated version of the Common Principles on Adaptation and highlighted the good cooperation with the MDBs group during the process of revising and updating these common principles to align them with the evolution of climate finance and enhance their effectiveness in supporting IDFC and MDBs members’ efforts in financing the climate transition.

Study “Helping public development banks navigate the Paris alignment” approaches”

IDFC’s proposals build on the unique and crucial role of Public Development Banks (PDBs) to accelerate the alignment of entire financial systems with the Paris Agreement, and the need to fully tap their potential. They highlight the importance of adopting a comprehensive approach for the future regime for climate action, combining quantitative and qualitative aspects. It is about embracing the imbricated and complementary challenges of

- dramatically increasing volumes serving low carbon and resilient pathways as well as loss and damage, including

- reorienting existing financial capital and flows, which remain largely inconsistent with low carbon and resilient countries’ development pathways,

- delivering climate finance dedicated to generating transformational impacts. In this regard, reinforcing the catalytic role of PDBs, in particular at national and sub-national levels (e.g by strengthening their capital base, facilitating their access to concessional resources, or providing capacity support, etc.) should be considered as transformational

Adoption of the new methodology of the Common Principles on adaptation and revision of the Common Principles on mitigation

IDFC announced the adoption of the revised version of the Common Principles on Mitigation and the updated version of the Common Principles on Adaptation.

We strongly believe that these new versions of the Common Principles will facilitate access to other banks willing to adopt the principles and enhance their climate finance investments.

Memorandum of Understanding with the Mainstreaming Climate Initiative (MCI)

IDFC supports the Initiative Mainstreaming Climate in Financial Institutions, a coalition of public and private financial institutions around the globe aiming to systematically integrate climate change considerations across their strategies, programs, and operations. With this agreement, IDFC and MCI build a joint roadmap for partnership and collaboration, based on two pillars: access to information on climate mainstreaming best practice, and knowledge sharing between IDFC members and multilateral development banks (MDBs) and private financial institutions.

“Since their creation, IDFC and Mainstreaming Climate in Financial Institutions have been looking in the same direction to foster dialogue and build capacity for financial institutions to progressively adapt and contribute to a sustainable future. The Initiative will support IDFC in enriching its exchanges on climate mainstreaming and rely on IDFC’s network to broaden its outreach among public development banks.”

Technical side-event: Climate Risk and Long-term Financing – integrating climate risk into development finance institutions’ risk management framework

The objective of this side event was to allow financial institutions to learn from each other’s respective experiences with climate risk management and latest developments on how to improve the climate risk assessment of their long-term portfolios and how to integrate it into their risk management framework.

Thanks to this session, we can see a better knowledge from supporting institutions and IDFC members about methodologies they could follow to implement TCFD recommendations and Paris alignment commitments.

We would like to thank the 7 panelists for their contribution:

- Claire Eschalier, Mainstreaming Climate in Financial Institutions Secretariat, I4CE

- Luciana Aparecida da Costa, Director for Infrastructure, Energy Transition & Climate Change, BNDES

- David Carlin, Head of Climate Risk & TCFD, UNEP FI

- Ayşe Nazlıca, Sustainability Coordinator, TSKB

- Laurent Bergadaa, Sustainable Finance Expert, AFD

- Gabriel Azevedo, Chief Strategy Officer, IDB Invest

- Thomas Allen, Senior Advisor to the Head of Secretariat, NGFS

David Carlin from UNEP FI has been presenting the 2023 Climate Risk Landscape with a focus on the importance of long-term horizons

“Our new report Emerging Economies: Climate Risks and Best Practices for Climate Risk Disclosure with ISSB, launched today, offers resources for policymakers, financial institutions, and newcomers in emerging economies’ climate sector.” David Carlin, Head of Climate Risk & TCFD, UNEP FI

During this event, we had also a presentation by Thomas Allen from NGFS on climate-related risks, scenario-analysis and the need for a forward-looking approach thanks to the NGFS Climate Scenarios for central banks and supervisors

“We should distinguish between transition planning, an internal process, and a transition plan, which is a key product of the planning process, aimed at ensuring transparency.” Thomas Allen, Senior Advisor to the Head of Secretariat, NGFS

CLICK HERE TO LEARN MOREThrowback to the discussion:

” We need the regulatory body to be involved. The sectoral roadmaps will be developed under the ministries, as Türkiye is almost at the end of its climate law preparation and long-term strategy on climate change.” Ayşe Nazlıca, Sustainability Coordinator, TSKB

“We, at BNDES, have to monitor our portfolio and not just look at carbon emissions in our balance sheet. We are working on a green taxonomy in alignment with the Ministry of Economy of Brazil.” Luciana Aparecida Da Costa, BNDES

“Our end goal is to adjust our credit risk scores to reflect climate risks, translating them into financial incentives or disincentives for our clients.” Luiz Gabriel Todt de Azevedo, Chief Strategy Officer, IDB Invest

“Thank you to the Mainstreaming Initiative because it’s important to share on this together and continue to improve our tools and analyses” Laurent Bergadaa, Sustainable Finance Expert, AFD

This session was closed by the last part with an experience-sharing between supporting institutions on their respective risk management practices and the special considerations for long duration portfolios.