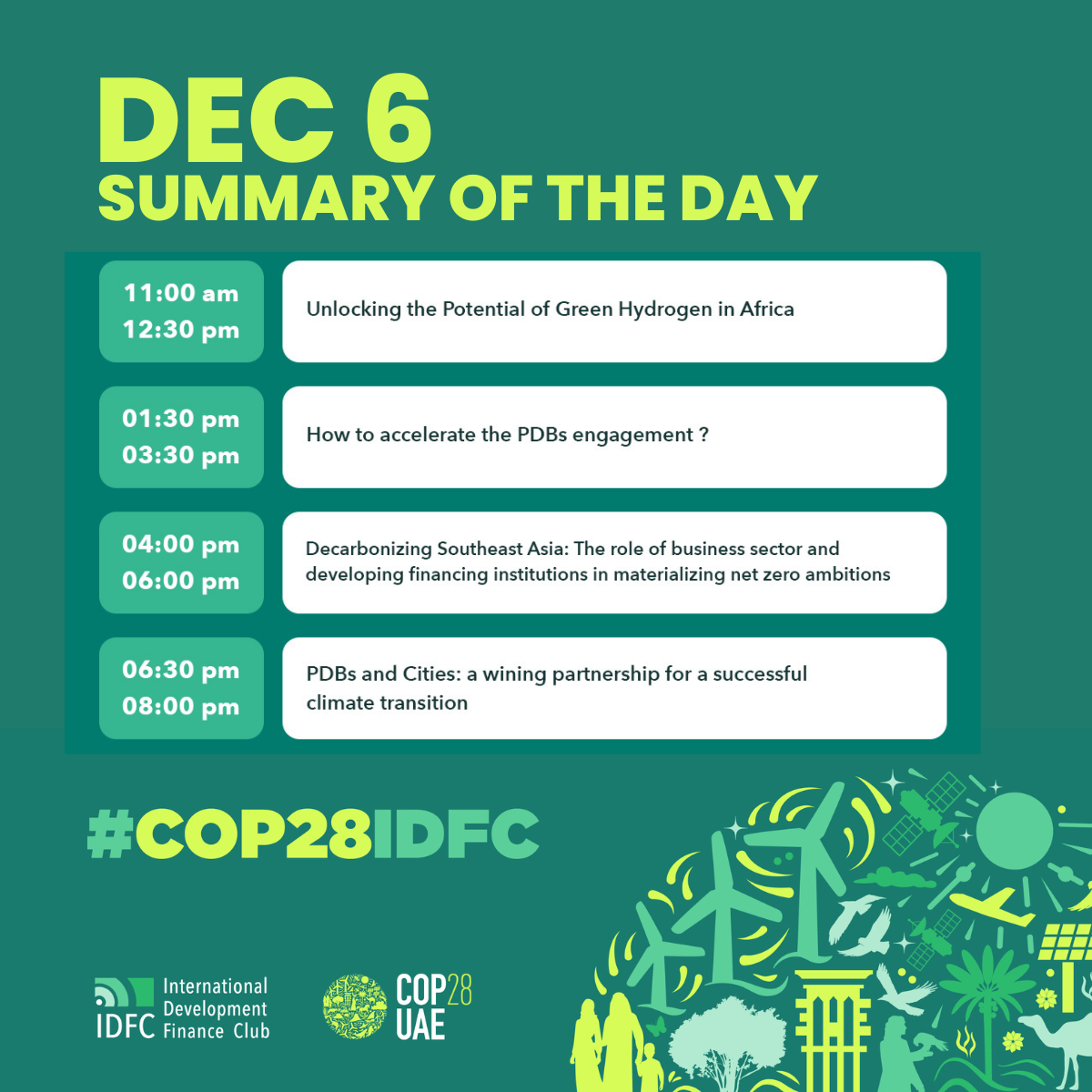

COP28IDFC DEC3 – Wrap up

3 December 2023The day 3 of the #COP28IDFC pavilion is now closed!

We talked about different topics on nature-based solutions, Forest Conservation, decarbonization but also urban climate finance.

Check the full agenda here: https://www.idfc.org/cop28idfc/

Below you can find the key takeaways and replay:

9AM Decarbonizing the Global South: challenges for development finance in hard-to-abate sectors

The session was based on one academic policy-oriented presentation from AFD team on the main risks and opportunities developing countries are facing given the transition. The presentation was followed by case studies. Development banks and policy makers have presented their transition plans, main funding challenges, and the main technological or nature-based solutions. Finally, speakers discussed common challenges and opportunities.

Quote from Guilherme Magacho from AFD

Transition risks for developing countries:

- Raising foreign currency to avoid BoP constraints: transition will demand imported inputs and machineries

- Raising fiscal revenues to avoid fiscal imbalances: it will also demand relevant public investments and social expenses

- Guaranteeing employment and wages: the global net impact may be positive, but it is heterogeneous in the country-level

Different strategies, different challenges:

- Business as usual: low impact on net exports (no need for extra imports), but is this competitiveness sustainable?

- Slow green transition (replace depreciated for green capital): demand for imports increases, but it may be not fast enough…

- Fast green transition: high demand for imports, generation of stranded assets, socioeconomic impacts are uncertain

Need for international cooperation

- CBAM: carbon tax on some countries that cannot easily move towards green industries (alternative: recycling taxes?)

- IRA: protect domestic market rather than supporting transition in economic partners (alternative: agreement with partners?)

- Important measures, but does not help a global transition (as they are now)

Luciana Costa Managing Director Sustainable Infrastructure, Energy Transition and Climate from BNDES

“Brazil has opportunities in all Energy Transition industries and can partner up with international players & investors in a world in transition to a low carbon economy”

Luciana insisted on:

The Energy Transition and decarbonization of the economy is a path of no return, however, the transition is not just about energy and must be socially just! The energy transition is a unique opportunity for the country become a global Green power, creating new industries, opportunities and addressing our major social & inequalities issues

Brazil is the 5th largest global emitter, but may be the first G20 economy to reach carbon neutrality. Our energy and power matrixes are the cleanest in the G20 and positions Brazil for Powershoring & Green Reindustrialization

Brazil can and must react, developing our natural vocation together with international partners, companies and invertors willing to have a significant role in. We offer a wide range of investment opportunities in biofuels, renewable generation, reforestation, low carbon & innovation industries (such as hydrogen), critical minerals and low carbon agriculture

During this event Nicolas Peltier from @WorldBank presented us a lot of examples to reduce transport carbon emissions as:

➡️First all-electric bus system in Africa

➡️Piloting E-Buses in Cairo

Watch the replay &get more infos on the researches 👉 https://t.co/1QkGU8ynyR— International Development Finance Club (@IDFC_Network) December 3, 2023

Kome Ajegbo, Vice President, Product Solutions & Sustainability, Africa Finance Corporation

All of Africa produces the same amount of power as Germany with less than 4% of GHG emissions.

As a result of loss and damage, 400 billion USD needed on an annual basis for Africa.

When we are thinking about hard-to-abate sectors, we need to think differently to see concrete improvements.

AFC’s mandate is to close the infrastructure gap in 5 key sectors: Oil & gas and mining, transport, heavy industries, power, tech

She insisted on the fact that for transport: we need to localise and start vertically and integrating on the continent and also that adaptation is critical, which is why set infrastructure resilience fund

Cristina Fróes de Borja Reis- Ministry of Finance of Brazil, Sub-Secretary of Sustainable Economic Development

11 AM Ready and Running: Legacy Landscapes Fund blends international finance for nature-based solutions

Key takeaways:

- Conservation and nature-based solutions need an area approach at scale in order to work

- Conservation and nature-based adaptation and mitigation results take time to surface and impacts need to be documented

- LLF covers the ongoing costs via a programmatic approach

- Human rights, local benefits and the rights-based approach are ensuring an integrated approach and mitigate risk

- Donors and implementing partners like the shared and transparent way of working and the learning and sharing opportunity of LLF

Dr. Heike Henn from German Federal Ministry for Economic Cooperation & Development @BMZ_Bund

“#NBS are truly important instruments that should not be neglected, but they must take into account not only nature but also people, human rights if they are to be beneficial” #COP28

— International Development Finance Club (@IDFC_Network) December 3, 2023

#COP28

At @IDFC_Network pavilion, @MBordlaurans:

“We heard the call on financing biodiversity loud & clear.

We are working towards alignment with the Kunming-Montreal Global Biodiversity Framework. Let’s now call for all willing partners to join & have the sectoral discussions.” pic.twitter.com/g4gCAORug1— AFD_en 🇫🇷 🇪🇺 (@AFD_en) December 3, 2023

Aileen Lee from @MooreFound “if we want to be effective, we need to find those mechanisms that enable us to move faster from place to place and to surround ourselves with partners who have been working in the area for a long time and know their environment” #COP28IDFC

— International Development Finance Club (@IDFC_Network) December 3, 2023

Stefanie Lang from Executive Director Legacy Landscapes Fund: “Protected areas are an effective #NBS that store and sequester carbon, if deforestation is reduced in the core & buffer zones of protected areas there will be significant annual reduction in carbon emissions.”#COP28

— International Development Finance Club (@IDFC_Network) December 3, 2023

Monica Medina @TheWCS

“Local people know very well how to protect nature, the problem is that they don’t always have the ressources to do it, like the uniforms, the rangers, the security ect, and that’s what a part of this fund should be used for” #COP28 #COP28IDFC— International Development Finance Club (@IDFC_Network) December 3, 2023

1PM Financing Forest Conservation and Sustainable Development in Pan- Amazon Region

Key takeaways of the session:

- Land use planning is relevant for the success of restoration initiatives.

- Protected area management and forest concessions are important to engage the private sector and leverage their participation.

- It is important to diversify financial instruments that can be used to restoration efforts.

- It is necessary to reduce costs for restoration and to attract private capital. Only working with grants will not be enough to achieve needed results.

- Success depends largely on simplicity. We must start with simple solutions, nature-based solutions.

- There is a need to scale up the supply chain to address restoration needs.

- To achieve the restoration goals there is a need to attract private sector partners.

- Traditional knowledge is important on the efforts to mitigate climate change.

- Connecting business with the territory can increase the outcomes.

Calls for action: Identify concrete work tracks mentioned by participants, explicit calls to action that could be included in the COP28IDFC landing page

4PM Why is MDB reform crucial to accelerating urban climate finance?

more infos to come

This event will discuss the key policy recommendations for MDB reform to accelerate urban climate finance identified in a new report developed by the Cities Climate Finance Leadership Alliance (CCFLA) in collaboration with the C40 Cities and the Global Covenant of Mayors (GCoM). Entitled ‘Accelerating Urban Climate Finance in Low-and Middle-Income Economies: An important strategic dimension of MDB reform,’ the report presents a comprehensive picture of the current landscape of MDBs’ contributions to urban climate finance and presents recommendations on how they can play an even more significant role in financing urban climate projects.