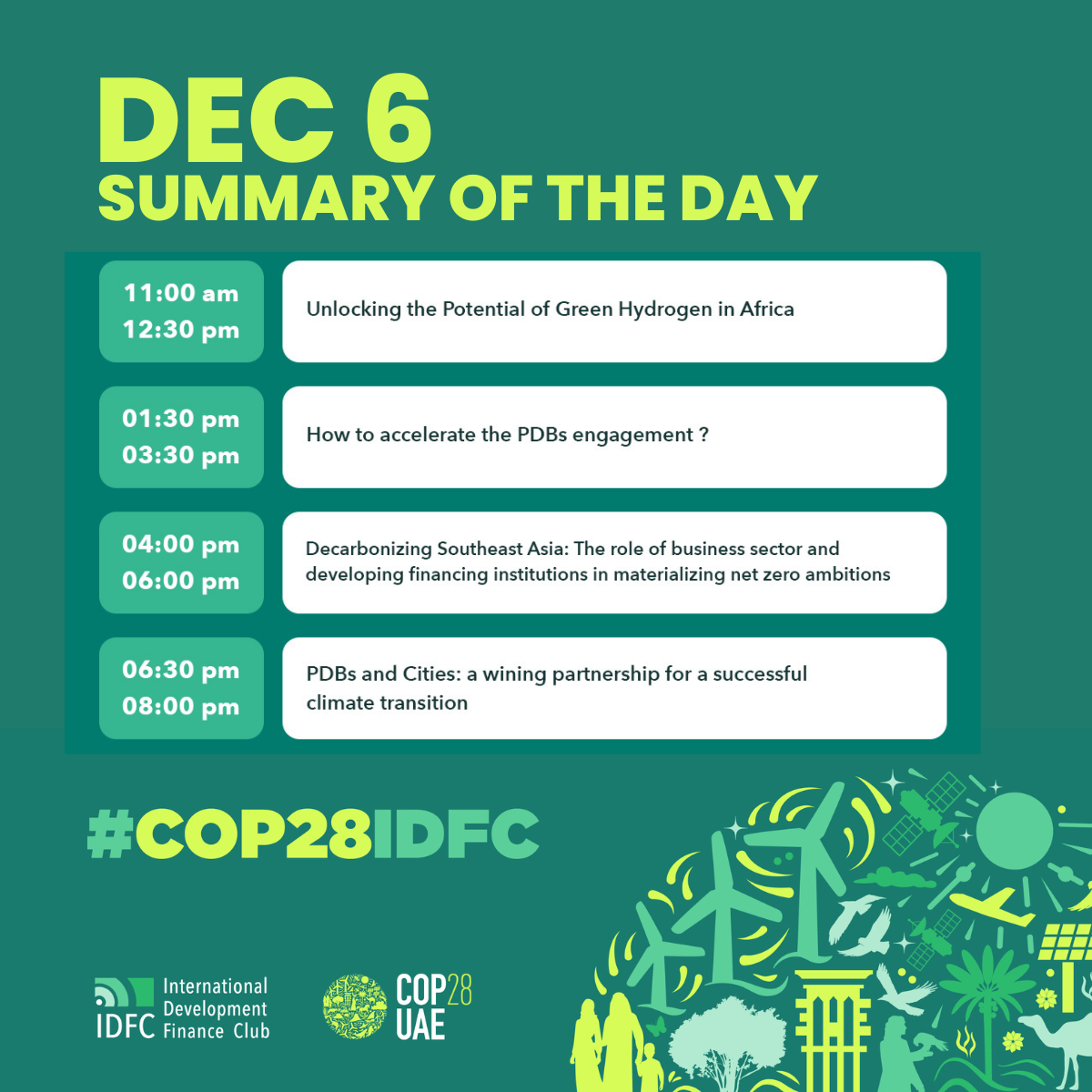

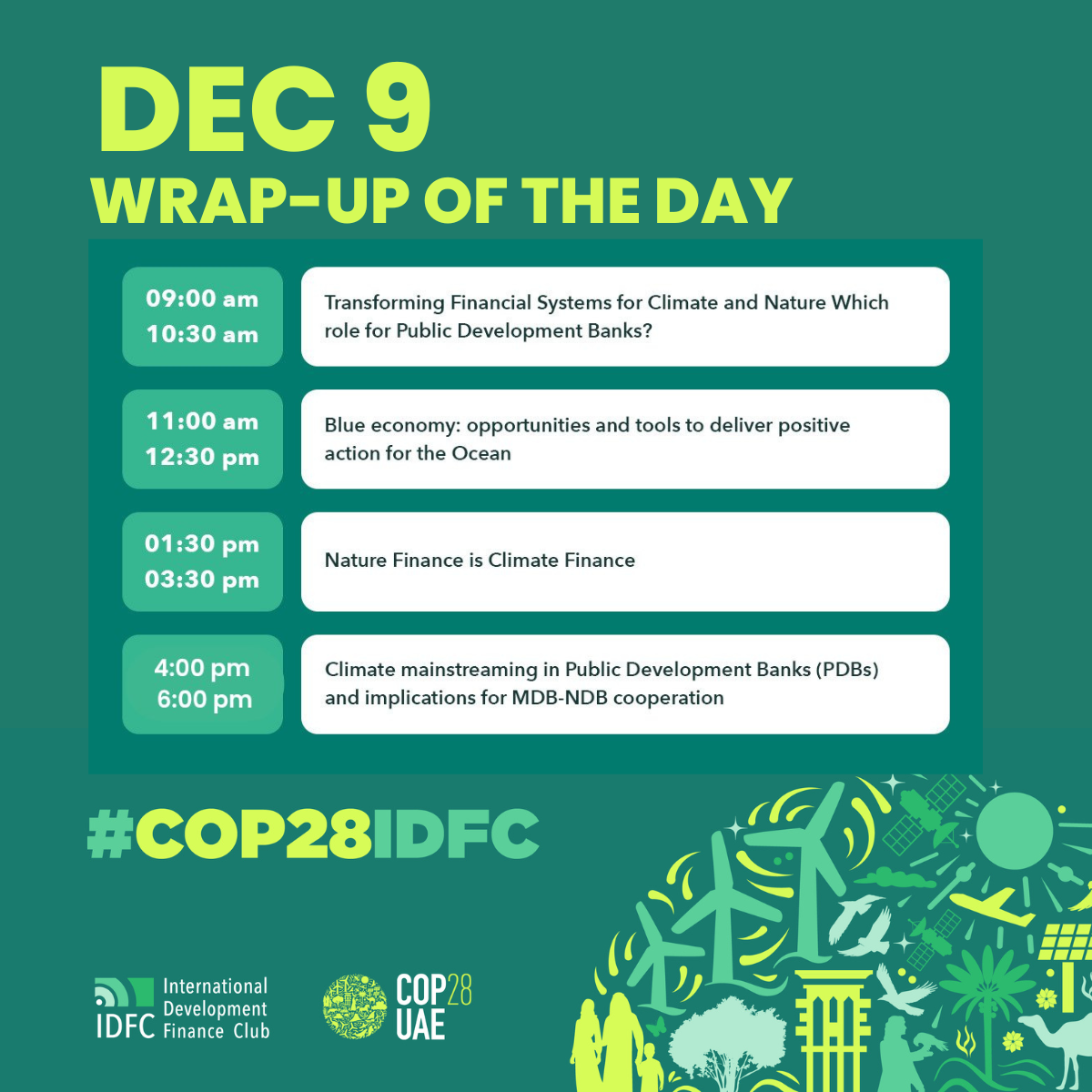

COP28IDFC DEC4 – Wrap up

4 December 2023Today, 4 of December, with 4 events, our experts go deeper on differents topics as Loss and Damages, Climate Finance, Risks, Insurances but also the role of PDBs on those topics.

Check the full agenda here: https://www.idfc.org/cop28idfc/

Watch the replay of the day:

9AM Building Together: An Inclusive Dialogue on the Role of Insurance Solutions in Addressing Loss and Damages.

The objective of the event was to delve into the possibilities that insurance and risk transfer mechanisms offer to address Loss and Damage (LnD) caused by climate change. This session has provided a comprehensive exploration of the opportunities and limitations inherent in insurance, its value for the Loss and Damage fund, and its possible roles within the landscape of funding arrangements set to be agreed upon at COP28.

Dr. Annette Detken from InsuResilience SolutionsFund added 3 other importants points:

1⃣awareness and understanding risk

2⃣understanding the insurance and the limite of insurance

3⃣affordability#COP28UAE #COP28UAE— International Development Finance Club (@IDFC_Network) December 4, 2023

.Quote from Catherine Simonet from @AFD_en @AFD_France #COP28UAE #COP28 #COP28IDFC pic.twitter.com/V1iwqaJj48

— International Development Finance Club (@IDFC_Network) December 4, 2023

Sara Ahmed, Finance Advisor @V20Group, and Dr. Astrid Zwick, Co-Director of the #GlobalShield Secretariat, highlighted the importance of understanding climate risks and elaborated on the role of insurance and other financial instruments for addressing climate-related losses ⤵️ pic.twitter.com/UyRnKn369A

— Global Shield (@TheGlobalShield) December 4, 2023

At @IDFC_Network‘s event on the role of insurance solutions in addressing #LossAndDamage today, Dr. Astrid Zwick explained how the #GlobalShield‘s inclusive In-Country Process can enable vulnerable countries to better understand climate risks & identify financial protection gaps pic.twitter.com/bt9TRTnafo

— Global Shield (@TheGlobalShield) December 4, 2023

11 AM Towards accountable climate finance: Establishing a people-centric financial mechanism to facilitate a just transition

Generate insights on the importance of people-focused financial mechanisms to achieve a more inclusive and equitable finance system that enables a participatory and transparent framework into climate and sustainable finance to ensure financial accountability

Panelists:

- Shih-Hong, Liu — Director, Department of Lending and Investment, TaiwanICDF

- Sophia Cheng — Chief Investment Officer, Cathay Financial Holding Company

- Tony Greeham — ESG Director, British Business Bank (BBB)

Key Takeaways:

- Countries should establish localized solutions with a humanist approach to facilitate social and economic development through stakeholders and civil society.

- Organizations should incorporate innovative technologies into their technical and financial support to enhance the resilience of groups vulnerable to climate change.

- Through cooperation with the global climate community and public–private partnerships, developed countries can better strengthen climate resilience.

Panelists contributions:

- Innovative approach to address climate change-instigated poverty The disasters induced by climate change, including hurricanes, mudslides, and floods, have caused large losses of life and property in Central America. Vulnerable populations are most affected, contributing to the cycle of poverty. Even though there is a wide range of inclusive financial service providers, such as cooperatives, credit unions, and microfinance institutions, they struggle due to a lack of liquidity. The TaiwanICDF is cooperating with IDB Lab, Covelo Foundation, and impact investors to establish a long-term financing facility to provide a financing fund to MFI. This facility provides a flexible response to natural and social events, helping small-scale producers resume production and restore quality of life.

- An integrated tool for real-time assistance The mechanism brought a multilateral development institution, a bilateral development institution, and the private sector together, thereby establishing a new cooperation platform for responding to global issues. It supports coordinated disaster responses as well as risk analysis and loan management, simultaneously supporting vulnerable groups and financial institutions.

- Public-private collaboration for expanded funding Furthermore, the government pension fund is participating in the mechanism, creating synergy from public-private cooperation.

Deliverables

CABEI and TaiwanICDF have launched a facility to support women’s economic empowerment in Guatemala.

In many developing countries, women play a significant role in the informal economy. Natural disasters and other threats from climate change, such as shifting rainfall patterns and pest outbreaks, can threaten food security and disrupt livelihoods in these nations. Women are more likely to experience economic hardships due to their limited access to financial resources, such as credit, property rights, and preferential loans.

TaiwanICDF and CABEI are collaborating on a facility that covers credit guarantee funds, soft loans, and technical assistance. This collaboration improves female small-scale producers’ access to financial support by sharing credit risks with financial institutions. At the same time, technical assistance is also provided to selected financial institutions to enhance their capacity to develop suitable financial products for women.

1.30 PM The success of the highly needed Loss and Damage agenda relies also on the critical engagement of Public Development Banks The role of pre-arranged climate finance

The operationalization of Loss and Damage agenda is urgent and is high in the discussions leading to the COP 28. Indeed, there are more numerous and significant consequences of climate change that are disrupting development financing mechanisms. The summit for a new global financial pact highlighted the need to develop new financing solutions that are more in line with current contexts.

#COP28

💬@MBordlaurans, climate & nature expert pointed out on the @IDFC_Network pavilion: “AFD has been a pioneer in financing loss & damage & is now offering solutions. However, it is imperative to coordinate with other PDBs to define & adapt these clauses to countries’ needs.” pic.twitter.com/zklrBUIQvf— AFD_en 🇫🇷 🇪🇺 (@AFD_en) December 4, 2023

4PM Fixing climate finance: the role of development finance institutions towards the 100 billion USD per year objective

Development banks, especially MDBs have been fundamental in establishing eligibility criteria for climate finance, and mobilizing the financial flows necessary for respecting this commitment. The objective of this side event was to investigate how development finance institutions can better contribute to the operationalization of climate finance and increase its volume to meet NDCs climate finance needs.

Key takeaways:

- In 2021, total climate finance provided and mobilised by developed countries for developing countries amount to USD 89.6 billion, falling USD 10 billion short of the goal. (Source: OECD (2023), Climate Finance Provided and Mobilised by Developed Countries in 2013-2021: Aggregate Trends and Opportunities for Scaling Up Adaptation and Mobilised Private Finance, Climate Finance and the USD 100 Billion Goal, OECD Publishing, Paris)

- Adaptation finance dropped by USD 4 billion (-14%) in 2021. (Source: Ibid)Pledges of finance to support countries to adapt to climate change are barely half of what they should be and there’s concern that some of these funds could be pledges to the new Loss and Damage Fund that are being double-counted. (Source: IIED (2023), Lack of progress on finance and negotiations at COP28)

- Mobilised private finance amounted to USD 14.4 billion in 2021, and this volume has been relatively stable since 2017. (Source: OECD (2023), Climate Finance Provided and Mobilised by Developed Countries in 2013-2021: Aggregate Trends and Opportunities for Scaling Up Adaptation and Mobilised Private Finance, Climate Finance and the USD 100 Billion Goal, OECD Publishing, Paris)

- Most public climate financing in 2021 consisted of loans (68%, or USD 49.6 billion) (Including concessional and non-concessional loans). Committing more finance in the form of grants (accounting for 28%, or USD 20.2 billion, of 2021 climate finance) (Source: OECD (2023), Climate Finance Provided and Mobilised by Developed Countries in 2013-2021: Aggregate Trends and Opportunities for Scaling Up Adaptation and Mobilised Private Finance, Climate Finance and the USD 100 Billion Goal, OECD Publishing, Paris) would support climate-vulnerable countries to adapt to the impacts of climate change while easing their current debt burdens. The cost of debt repayment for 59 nations was USD 33 billion compared to USD 20 billion they received in climate finance in 2021. (Source: IIED (2023), Poorest countries spending billions more servicing debts than they receive to tackle climate change)

- There are significant opportunities for international providers to tackle these two critical areas by: ensuring that their financial toolkits are well tailored to current market dynamics; revising their mandates and operational approaches to ensure they are fit for purpose; collaborate more intensively with partner countries to strengthen their abilities to access, absorb and attract climate finance.

Relevant interventions:

- DFIs and MDBs need to increasingly adopt and foster innovative financial instruments such as: (1) debt swaps for climate and nature, (2) parametric insurance, and (3) state-contingent debt clauses, could be key to addressing the ‘triple crisis’ of unsustainable debt, climate change and biodiversity loss in vulnerable countries.

- Debt swaps: In 2023, Ecuador signed the biggest debt-for-nature deal ever. The country will buy back USD 1.6 billion of its debt with a USD 656 million loan invested in conservation activities in the Galapagos. Cabo Verde also announced that it was entering into a debt-for-climate-and-nature swap with Portugal (its major creditor), planning to swap the USD 153 million debt for investments in the archipelago’s environmental and climate fund. (Source: IIED (2023), Redesigning debt swaps for a more sustainable future ; Reuters (2023), Portugal to swap $153 million Cape Verde debt for nature investments ; GGGI (2023), Ecuador Debt-for-Nature Swap in the Galapagos Islands Launched)

- Parametric insurance: form of indemnity that covers a government’s debt repayments during a period of climate-driven crisis (e.g., drought, cyclones, etc.), allowing it to focus on recovery.

- State-contingent debt clauses are currently applied in Grenada, Barbados and The Bahamas, allowing these states, to pause service payments in the event of a natural disaster, debt such as a cyclone. (Source: Clearly Gottlieb (2021), Sovereign Debt Evolution: The Natural Disaster Clause)

- Increasing transition finance is an opportunity to transition towards net zero and reduce exposure to transition risk. Eligibility criteria for transitional investments vary across jurisdictions depending on their emissions contribution and economic significance. DFIs have a significant role to play in helping redirect financial flows to support just transitions.

- De-risking investments in nature-based projects and effective mitigation solutions, including by increasing the use of guarantees, DFIs will help attracting private

Chiara Falduto, Climate Finance Policy Analyst, OECD

Tom Mitchell, Executive Director, IIED

Edmund Bala-Gbogbo, ESG Officer and Senior Risk Manager, Afreximbank

Nicola Mustetea, Head of Climate, British International Investment

Monika Beck, Managing Director, DEC KfW

Carrie Walczak, Senior Advisor, Sustainability Strategy & Policy, FMO

Guillaume Barberousse, Director Sustainable Development, Proparco